Pvm Accounting for Beginners

Pvm Accounting for Beginners

Blog Article

Some Of Pvm Accounting

Table of ContentsThe Ultimate Guide To Pvm AccountingThe Of Pvm AccountingAll about Pvm AccountingExamine This Report on Pvm AccountingFascination About Pvm AccountingThe Best Strategy To Use For Pvm AccountingThe smart Trick of Pvm Accounting That Nobody is Discussing

In terms of a business's overall approach, the CFO is in charge of guiding the company to meet monetary objectives. Some of these methods could include the business being gotten or acquisitions moving forward. $133,448 annually or $64.16 per hour. $20m+ in yearly revenue Service providers have progressing demands for office managers, controllers, bookkeepers and CFOs.

As a business grows, bookkeepers can release up more team for various other service duties. As a building firm grows, it will require the help of a full time economic staff that's handled by a controller or a CFO to manage the company's funds.

The 5-Second Trick For Pvm Accounting

While large companies may have full-time financial support groups, small-to-mid-sized companies can work with part-time bookkeepers, accountants, or economic advisors as needed. Was this short article practical? 2 out of 2 individuals located this useful You voted. Adjustment your answer. Yes No.

As the building and construction market continues to thrive, companies in this field should keep strong economic monitoring. Effective bookkeeping methods can make a substantial difference in the success and growth of construction business. Allow's explore five necessary accounting practices tailored particularly for the building and construction sector. By applying these methods, building and construction companies can boost their economic security, streamline procedures, and make informed decisions - Clean-up accounting.

Detailed estimates and spending plans are the backbone of construction job monitoring. They assist steer the job towards timely and successful conclusion while guarding the rate of interests of all stakeholders involved.

The Definitive Guide to Pvm Accounting

A precise evaluation of products required for a task will certainly help make sure the required materials are bought in a prompt fashion and in the best quantity. A mistake below can lead to wastefulness or hold-ups as a result of material lack. For many building and construction tasks, equipment is required, whether it is acquired or rented out.

Correct tools estimate will assist make certain the ideal tools is readily available at the correct time, conserving time and money. Don't forget to represent overhead expenses when estimating project costs. Direct overhead expenditures are specific to a project and may include momentary leasings, energies, secure fencing, and water products. Indirect overhead expenditures are daily costs of running your business, such as rental fee, administrative salaries, utilities, tax obligations, depreciation, and advertising.

One various other variable that plays right into whether a job succeeds is an exact price quote of when the job will be finished and the associated timeline. This estimate assists make sure that a job can be ended up within the designated time and sources. Without it, a project might run out of funds prior to completion, causing prospective job interruptions or desertion.

Our Pvm Accounting Ideas

Accurate work costing can assist you do the following: Recognize the success (or do not have thereof) of each task. As work setting you back breaks down each input into a task, you can track earnings independently.

By recognizing these things while the project is being finished, you avoid surprises at the end of the project and can resolve (and hopefully prevent) them in future jobs. One more tool to help track jobs is a work-in-progress (WIP) timetable. A WIP schedule can be finished monthly, quarterly, semi-annually, or every year, and includes task data such as agreement value, costs incurred to date, total approximated this page prices, and overall job invoicings.

More About Pvm Accounting

It additionally provides a clear audit trail, which is vital for financial audits. construction accounting and compliance checks. Budgeting and Forecasting Devices Advanced software uses budgeting and forecasting abilities, allowing building and construction companies to plan future jobs extra accurately and handle their funds proactively. Document Monitoring Building and construction projects include a lot of paperwork.

Improved Vendor and Subcontractor Management The software can track and take care of repayments to vendors and subcontractors, ensuring prompt payments and keeping great connections. Tax Preparation and Filing Bookkeeping software program can aid in tax obligation prep work and filing, guaranteeing that all appropriate economic activities are accurately reported and tax obligations are filed on time.

The smart Trick of Pvm Accounting That Nobody is Discussing

Our client is a growing development and building company with head office in Denver, Colorado. With numerous energetic construction tasks in Colorado, we are searching for an Audit Aide to join our team. We are looking for a permanent Accountancy Aide that will certainly be responsible for giving functional support to the Controller.

Receive and evaluate everyday invoices, subcontracts, change orders, acquisition orders, check demands, and/or various other relevant paperwork for completeness and conformity with economic policies, procedures, budget, and contractual requirements. Exact processing of accounts payable. Get in billings, approved draws, acquisition orders, and so on. Update monthly evaluation and prepares budget plan trend records for building and construction tasks.

Not known Details About Pvm Accounting

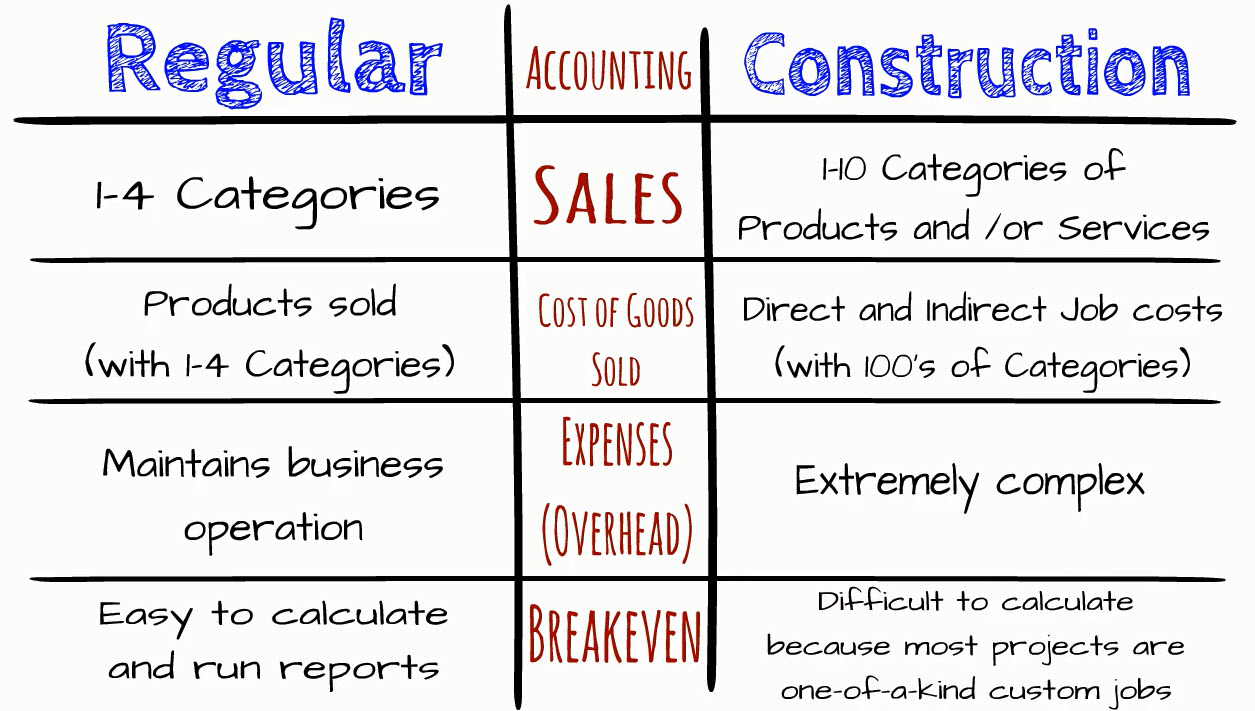

In this guide, we'll dive into different aspects of building accountancy, its relevance, the criterion tools used in this field, and its role in construction tasks - https://pvmaccount1ng.start.page. From monetary control and expense estimating to cash money flow administration, check out just how accountancy can profit construction tasks of all ranges. Building and construction audit refers to the specialized system and procedures utilized to track financial details and make tactical decisions for construction organizations

Report this page